Chase Personal Line Of Credit: Your Guide To Flexible Finances

In today's volatile financial environment, is it possible to confidently navigate the complexities of managing your finances and seizing opportunities? Absolutely. Chase personal lines of credit stand as a beacon of financial flexibility, designed to empower you to meet both anticipated and unexpected expenses.

The modern financial landscape demands adaptable solutions. Unlike traditional loans that lock you into fixed payments, a Chase personal line of credit provides a revolving credit line. This grants you access to funds up to a pre-approved limit, allowing you to borrow only what you need, when you need it, and pay interest only on the utilized amount. This structure distinguishes it from a standard loan, making it particularly appealing for individuals seeking financial control without the rigidity of fixed monthly obligations. The objective of this piece is to dissect the intricacies of this credit instrument, offering a comprehensive guide to help you harness its potential.

| Understanding Chase Personal Lines of Credit | |

|---|---|

| Concept: | A flexible credit tool providing a pre-approved borrowing limit. |

| Key Feature 1: | Revolving Credit - Borrow, repay, and borrow again. |

| Key Feature 2: | Variable Interest Rates - Rates fluctuate based on market conditions. |

| Key Feature 3: | Flexible Repayment Terms - Interest-only or principal payments possible. |

| Key Feature 4: | Convenient Access - Funds available via checks, online transfers, or in-person withdrawals. |

| Primary Use Cases: | Home improvements, debt consolidation, medical expenses, and general cash flow management. |

To fully leverage a Chase personal line of credit, it is essential to first evaluate your eligibility. This section explores the key criteria used by Chase to assess your application, including but not limited to factors like credit score, income stability, debt-to-income ratio, and employment history. It's vital to understand that meeting these criteria significantly boosts your approval chances, opening doors to greater financial control.

- Temporary Replacement Parts Your Essential Guide Amp Faqs

- Megan Fox The Ultimate Guide To Her Career Life

The most essential factor in this context is the applicant's credit score. A good or excellent credit score, generally considered to be 670 or higher, greatly increases the likelihood of approval. However, a high credit score is not the only indicator of creditworthiness. Lenders carefully evaluate the applicant's debt-to-income ratio (DTI), which measures the proportion of monthly debt payments relative to monthly income. A low DTI indicates that the applicant effectively manages current debt obligations, thereby increasing their chances of securing a personal line of credit. Finally, consistent employment history demonstrates financial stability, adding further weight to the application.

Beyond the eligibility criteria, a thorough grasp of the associated interest rates and potential fees is crucial. Unlike some financial products that have fixed interest rates, personal lines of credit typically use variable interest rates, which fluctuate in response to market conditions. This dynamic can make budgeting more complex, as monthly payments may vary. Moreover, it is essential to be cognizant of the possible fees involved, which might include an origination fee, an annual fee, and fees associated with late payments. Awareness of these costs is a prerequisite to sound financial planning, enabling the user to avoid unpleasant surprises and manage the credit line effectively.

The application process for a Chase personal line of credit is structured to be straightforward, but its still important to approach it with preparedness and precision. Before even starting the application, the first step is assembling the necessary documents. Proof of income, in the form of pay stubs or tax returns, will be required. Personal identification, such as a driver's license or passport, will be necessary to verify your identity. Furthermore, be prepared to provide bank statements. Once these documents are ready, you can proceed to complete the application, which is available online or in person at a Chase branch. The process typically takes a short amount of time, and you should receive a decision promptly. Diligence in gathering these documents can streamline the application process.

Chase personal lines of credit deliver several key benefits, solidifying their appeal as a financial tool. The primary advantage is flexibility. Borrowers can draw funds as needed, up to their approved credit limit, making it ideally suited for managing fluctuating expenses. Cost-effectiveness is another notable feature. Since interest is charged only on the amount used, it can often be more economical than traditional loans that levy interest on the entire principal. Lastly, the convenience of accessing funds through checks, online transfers, or branch withdrawals adds significant user-friendliness.

When you have the freedom to access funds up to a predetermined limit as needed, the possibilities expand. A Chase personal line of credit offers practical solutions for a diverse array of requirements. From major home renovations to consolidating high-interest debt, the line of credit can provide much-needed financial resources. Additionally, these credits often serve as a financial lifeline for medical bills, allowing individuals to focus on their health without the added stress of immediate financial strain.

Effective management is key to fully utilizing a Chase personal line of credit. Developing a detailed budget that incorporates credit line payments is crucial for staying on track with repayment. Making timely payments is not only vital for avoiding late fees, but also for protecting your credit score. Regular monitoring of your balance ensures that you remain within the credit limit. By adhering to these principles, you can successfully avoid the pitfalls of irresponsible borrowing and maximize the advantages of a Chase personal line of credit.

While offering multiple advantages, it's essential to avoid the pitfalls that could undermine your financial stability when utilizing a Chase personal line of credit. A common mistake is borrowing more than what you need. Resist the temptation to draw the maximum amount available; only borrow what is strictly necessary to prevent the accumulation of unnecessary debt. Another common pitfall is ignoring the repayment terms; failing to understand your payment obligations can lead to missed payments and financial strain. Finally, restrict your line of credit to essential expenditures rather than discretionary purchases.

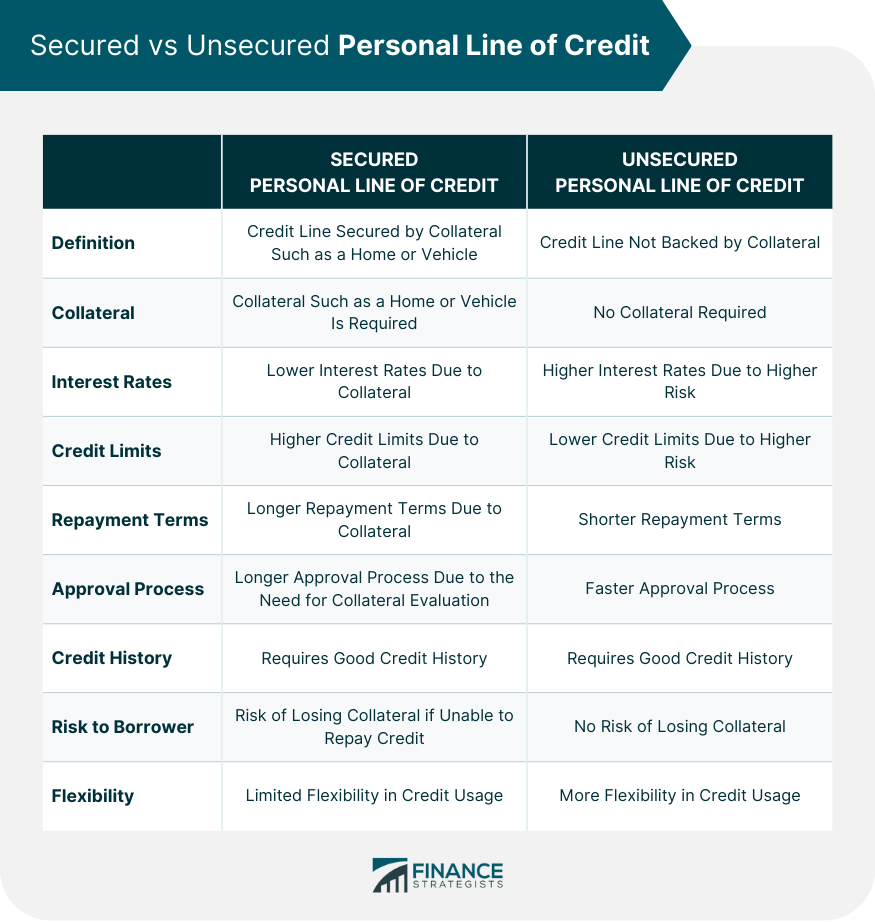

Comparing a Chase personal line of credit with other credit options can help you decide on the optimal solution for your financial requirements. Although both offer revolving credit, lines of credit typically provide lower interest rates and higher credit limits than standard credit cards. While personal loans offer a lump sum with set payments, lines of credit provide greater flexibility, allowing you to draw funds as needed. Home Equity Lines of Credit (HELOCs), which use your home as collateral, may offer lower interest rates but carry the risk of losing your property if you default.

To ensure clarity and provide comprehensive answers, here are some frequently asked questions related to Chase personal lines of credit.

| Frequently Asked Questions | |

|---|---|

| Can I Use My Chase Personal Line of Credit for Anything? | Yes, but it's essential to use it responsibly. |

| What Happens If I Miss a Payment? | Late fees and a negative impact on your credit score are the consequences. |

| Is There a Penalty for Paying Off My Line of Credit Early? | No, early repayment can actually improve your credit score. |

These FAQs and explanations aim to clarify any residual concerns and promote financial literacy. For additional information, contact the financial institution.

The strategic utilization of a Chase personal line of credit can be a crucial tool in achieving your financial goals. The tool offers flexibility, cost-effectiveness, and convenience, by understanding the essential elements of the eligibility criteria, interest rates, and application process, you can confidently determine whether it aligns with your financial needs. Take the initiative to explore your options and apply for a Chase personal line of credit.

Financial success requires careful planning and access to credit. A Chase personal line of credit is the best tool for people who are looking for a trustworthy and reliable source.

Detail Author:

- Name : Bessie Konopelski II

- Username : econsidine

- Email : green.ronny@hotmail.com

- Birthdate : 1976-03-10

- Address : 13697 Will Keys Apt. 417 Haileehaven, IA 98348

- Phone : +18473157493

- Company : Pfannerstill-Hartmann

- Job : Custom Tailor

- Bio : Eos libero quas velit illo a consectetur. Alias blanditiis et expedita repellat. Dolorem aut et ea iusto sunt.

Socials

twitter:

- url : https://twitter.com/borerr

- username : borerr

- bio : Maiores sint omnis est. Doloribus ducimus quod blanditiis id atque rerum dolorem.

- followers : 1245

- following : 107

tiktok:

- url : https://tiktok.com/@borerr

- username : borerr

- bio : Adipisci omnis ut occaecati libero iure magni ut.

- followers : 3485

- following : 1668

facebook:

- url : https://facebook.com/rebekah_official

- username : rebekah_official

- bio : Delectus aspernatur repudiandae natus aspernatur cum porro.

- followers : 3164

- following : 2595

instagram:

- url : https://instagram.com/rebekahborer

- username : rebekahborer

- bio : Laudantium eveniet aperiam perferendis accusantium. Ut at laborum reiciendis occaecati in nihil.

- followers : 6972

- following : 2206

linkedin:

- url : https://linkedin.com/in/rebekah_id

- username : rebekah_id

- bio : Iste qui odio itaque aperiam dolorem reiciendis.

- followers : 3145

- following : 275